Increases in income tax rates and unemployment benefits have enhanced their importance as automatic stabilizers. Rising transfer payments and falling tax collections helped cushion households from the impact of the recession and kept real GDP from falling as much as it would have otherwise.Īutomatic stabilizers have emerged as key elements of fiscal policy. Real disposable personal income thus fell by only 0.9% during the 2001 recession, a much smaller percentage than the reduction in real GDP. Furthermore, the reduction in incomes increased transfer payment spending, boosting disposable personal income further. The reduction in economic activity automatically reduced tax payments, reducing the impact of the downturn on disposable personal income. Real GDP fell 1.6% from the peak to the trough of that recession.

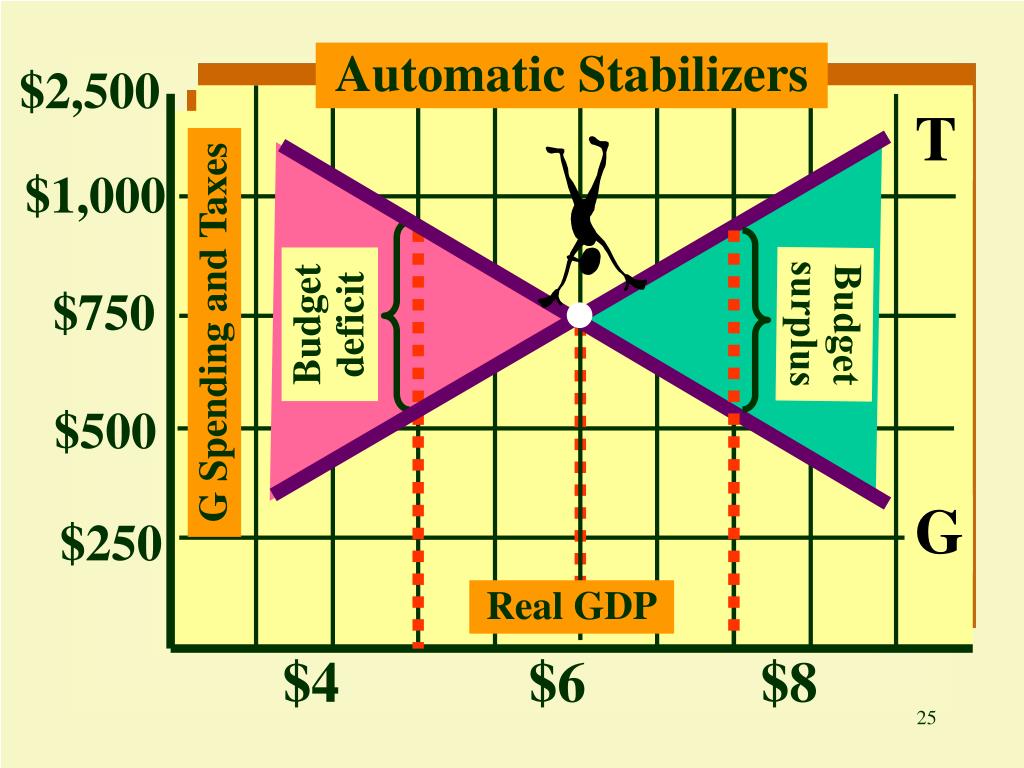

To see how automatic stabilizers work, consider the decline in real GDP that occurred during the recession of 1990–1991. Automatic stabilizers tend to increase GDP when it is falling and reduce GDP when it is rising. As incomes fall, people pay less in income taxes.Īny government program that tends to reduce fluctuations in GDP automatically is called an automatic stabilizer.

Because more people become eligible for income supplements when income is falling, transfer payments reduce the effect of a change in real GDP on disposable personal income and thus help to insulate households from the impact of the change. Certain government expenditure and taxation policies tend to insulate individuals from the impact of shocks to the economy.

0 kommentar(er)

0 kommentar(er)